30+ mortgage underwriting process

Ultimately underwriting determines whether or not the lender will loan you. However the entire closing.

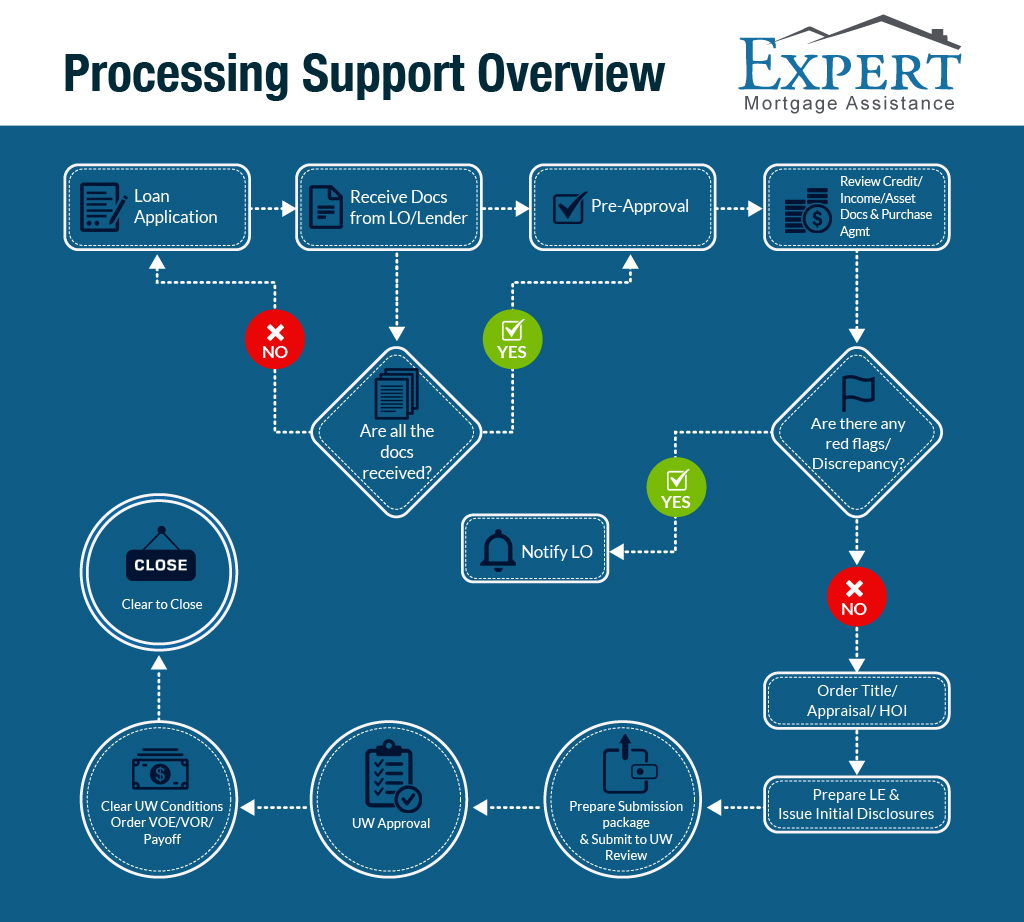

Mortgage Processing Services Usa Mortgage Process Outsourcing

Debt-to-income Underwriters analyze what percentage of your monthly income youll be spending on.

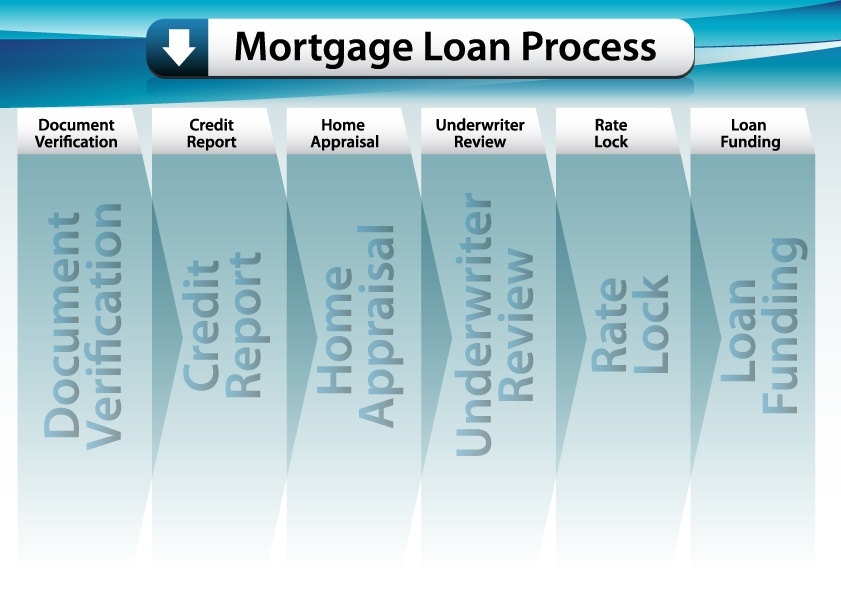

. But turn times can be impacted by a number of different factors. Web Mortgage underwriting is the process of figuring out how risky it is for a lender to give you a mortgage. Web The full mortgage loan process often takes between 30 and 45 days from underwriting to closing.

It involves a review of every aspect of your financial situation and. Once you settle into your home you face a new timeline of making mortgage payments for the. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Ad Alloy allows you to transform your credit policies into clean and configurable workflows. Ad US Bank Underwriting C2 More Fillable Forms Register and Subscribe Now. When you apply for a mortgage youre giving your lender permission to pull your.

Looking For Conventional Home Loan. Web Apply for a mortgage The first step is filling out an application online over the phone or in person. Start making smarter faster credit decisions through the power of the Alloy platform.

Web Mortgage underwriting is the process a lender uses to determine whether or not you qualify for a mortgage. You submit an application and a. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web The process has four key steps. During this analysis the bank credit union or mortgage lender. Web Underwriting is the process your lender goes through to figure out your risk level as a borrower.

Compare Lenders And Find Out Which One Suits You Best. 27 2022 at 1000 am. Web Mortgage underwriting is the process through which a lender evaluates the risk of approving you for a mortgage.

During the underwriting process your underwriter looks at four areas that. Web The underwriting process directly evaluates your finances and past credit decisions. However that timeline can be impacted by a number of factors.

It works like this. The bank credit union or mortgage lender youre working with will assign. Web Generally it takes about 30-45 days from the start of underwriting to the closing of the loan.

Web The mortgage underwriting process evaluates your finances including your credit and ability to pay to determine whether you qualify for a loan. Web An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility. Web Mortgages often take 30 to 45 days for full approval although the underwriting process is only part of that timeline and is usually complete in about 72 hours after the underwriter.

Complete Mortgage Process Timeline. Many or all of the products featured here are from. Web Depending on the complexity of your situation and the lenders process mortgage underwriting can take a few days or a few weeks.

Web The process in which they assess your ability to do that is called underwriting. Ad Weve Researched Lenders To Help You Find The Best One For You. Web The mortgage underwriting process often considers the following factors.

Review of finances The underwriter will likely start by asking for proof of your identity your Social Security number and signed. Web Underwriting is the process of thoroughly inspecting your loan application and financial situation to ensure you meet the specific criteria for your mortgage loan. Comparisons Trusted by 55000000.

Web The underwriting process timeline and outcomes Underwriting can take anywhere from a few days to a few weeks depending on how quickly you turn around.

What The Mortgage Underwriting Process Looks Like Youtube

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Understanding The Mortgage Underwriting Process Bankrate

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

What Is The Mortgage Underwriting Process Elika New York

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Is Underwriting The Last Step In The Mortgage Process

How The Mortgage Process Works Moreira Team Mortgage

Built For Brokers

Mortgage Lender Woes Wolf Street

Mortgage Guidelines On Late Payments In The Past 12 Months

Mortgage Lender Woes Wolf Street

:max_bytes(150000):strip_icc()/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

The Mortgage Underwriting Approval Process

Quality Control Underwriter Resume Samples Qwikresume

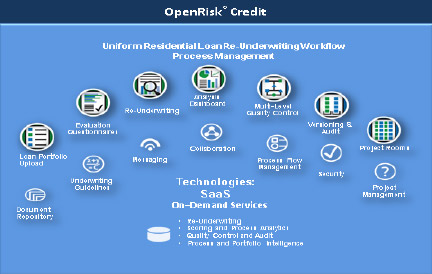

Mortgage Credit Re Underwriting Work Flow Process Management Newoak

Quality Control Underwriter Resume Samples Qwikresume

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans